Squaring Price That Ended a Prior Trend with Time in the Current Trend

This an easy technique to apply. You need only convert the price ( high, low or close) that ended a prior trend to degrees on the Square on Nine with the time in TDs or CDs (converted to degrees) of the current trend to see if the market is squaring price with time on the bar or day of interest. Because the base price is fixed you can easily use the new formula to forecast a grid of future TDs and CDs on which you will want to pay special attention to the market or to your particular ticker to get a sense of an ending trend.

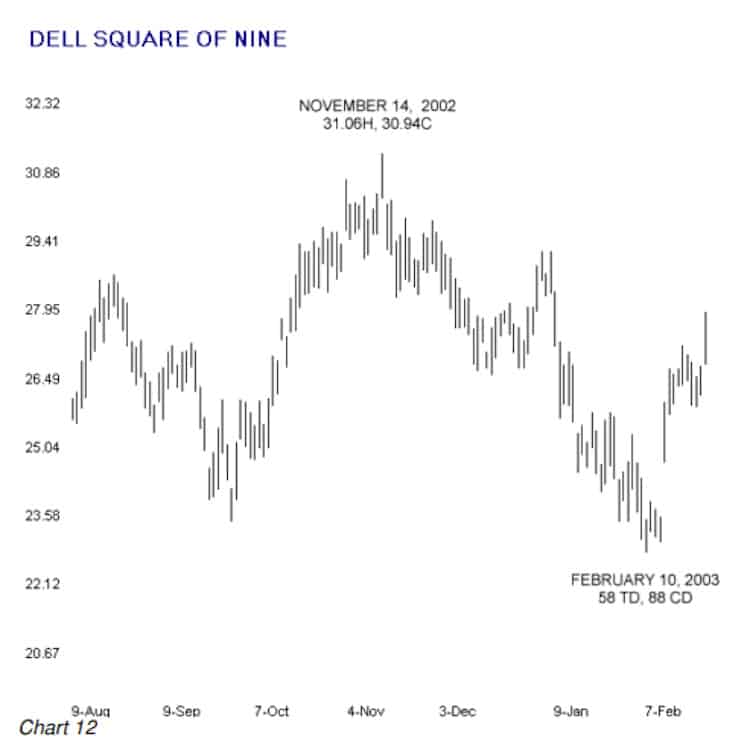

Let’s work the same DELL chart that we used for the last example and see if there was more than one way to get to the square of price and time on February 10, 2003.

The highest close of the swing ending on November 14, 2002 was 30.94. Converted first to 309.4 and plugged into the first formula we find that price lies on the 61 degree angle on the Square of Nine. Plugging 61 degrees and each of the 90 degree oppositions of 61 degrees into the new formula that tells us what numbers lie on the 61 degree angle shows TD and CD days of interest of 57, 65, 75, 83. Based on the closing price of the swing that ended in November, 2002, the TD calculation is within one day of square on February 10.

For completeness, let’s do the calculation based on the highest price of the November swing. The highest high of the same swing was 31.06, converted to three digits = 310.6, converted to degrees = 67 degrees. Plugging 67 degrees into the new formula and jumping to the 3rd iteration shows 58 TD as a day of interest.

On February 10, 2003 you knew that DELL squared price and time in at least two different ways. In the previous chapter we determined that the price range of the swing that terminated in November squared with time of the current swing on February 10, 2003. Actually, by applying both formulae you could have known to a certainty at the close of trading on November 14, 2002, that DELL would square price and time in two ways on February 10, 2003.

What you did not know to a certainty on February 10, 2003 was that DELL had changed trend that day and was beginning an almost uninterrupted 40% advance. There is no mathematical or magic formula for determining which squaring of price and time will result in a change in trend that produces a big move but with use and experience you will develop a trader’s sense of which squarings are likely to be the most important.

We used both formulae for the DELL example in this chapter. You could have used only the first formula, the one that converts price or time into degrees, to determine that 58 TD converts to 65.8 degrees. What’s the possible advantage to having the second formula? It’s easier and more convenient to project ahead for times or prices of interest by using the second formula. If DELL had not made a reversal on February 10, the 58th TD, we would have known that we should be looking for that reversal on the 65th or 75th TD or CD because these numbers also lie on the 61 degree angle of the Square of Nine.

| << Squaring The Price Range in the Prior Trend with Time in the Current Trend | SO9 7.6 Squaring The Price Range Of The Current Trend With Time Of The Current Trend (tradingfives.com) >> |

Pingback: SO9 7.4 Squaring The Price Range In The Prior Trend With Time In The Current Trend

Pingback: SO9 7.6 Squaring The Price Range Of The Current Trend With Time Of The Current Trend